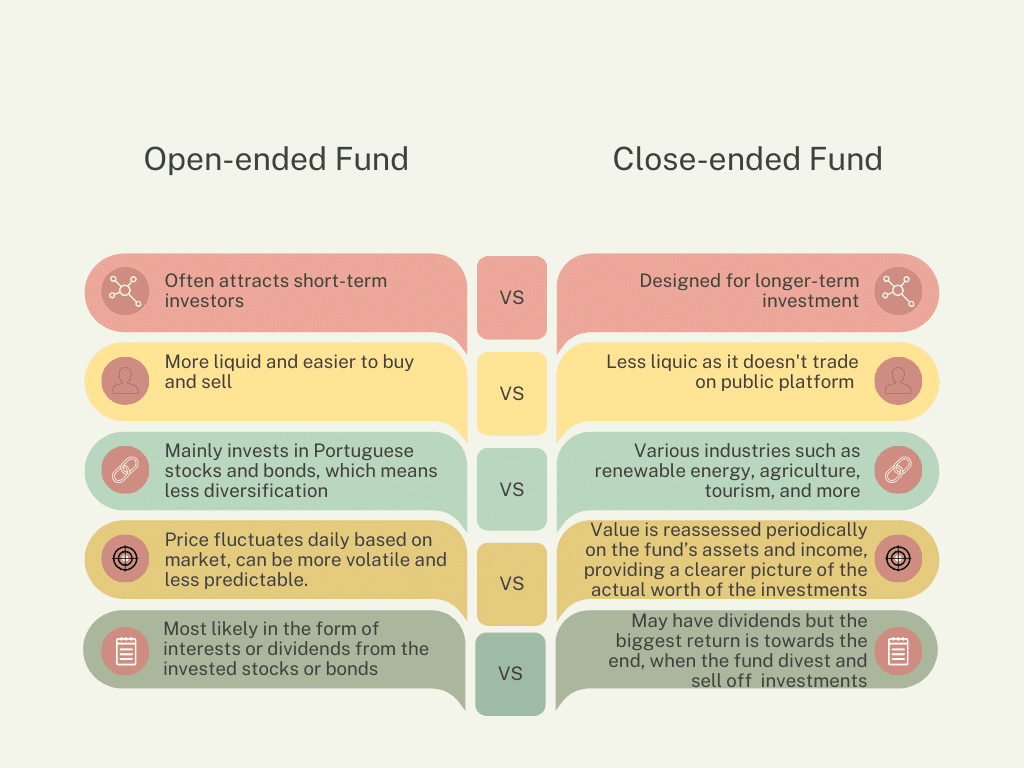

When considering the numerous fund investment options available for the Portuguese Golden Visa, you might notice an interesting detail: funds are categorized into two major types, open-ended and closed-end funds. This might lead you to wonder: Are closed end funds good investments ? Which is better for investment, open-end or closed-end funds? In reality, the characteristics of open-end and closed-end funds are quite different. They vary in terms of duration, issuance terms, trading methods, and pricing factors. For Golden Visa investors, understanding these distinctions is crucial as they have profound implications for immigration investment choices.

In this blog post, we will delve into a detailed comparison of open end funds and closed end funds, exploring which types of funds better align with Golden Visa investment rules and offer greater security for you.

Table of Contents

- What are Open-End Funds?

- What are Closed-End Funds?

- The Life Term For Golden Visa Funds

- Open End Funds Versus Closed End Funds

- Why Invest In Closed End Funds?

- Key Takeaways: Pros & Cons

What Are Open Ended Funds?

Open End funds (OEF) represent a versatile and dynamic investment option that you can buy and sell at any time. There is no limit to how many shares an open-end fund can issue, meaning shares are unlimited. Investors can quote the buy and sell price of each share based on their Net Asset Value (NAV) at any time through banks or authorized sales agencies.

One of the key features of open-end funds is their flexibility. The price per share divides NAV by the number of shares outstanding.The number of shares can fluctuate based on investor activity, meaning that the value of these funds can rise or fall, much like stocks, providing both profit opportunities and risks.

These open ended funds don’t have a fixed term, and can theoretically run indefinitely, until fund manager decides to liquidate and close the fund.

What are Closed Ended Funds?

Closed-end funds (CEF) operate with a definite and predetermined issuance term. Closed-end funds sell their shares during a one-time subscription period, much like a company sells stock during an initial public offering (IPO), only this subscription period can last for 2 years or even longer.

After this initial period, the fund will be closed and will not entertain any new subscriptions. The next phase is the investment period. Occasionally, if good investments are found and necessary funds are raised, the investment phase may begin earlier, even during the subscription period. This leads to the final phase, known as the divestment period.

For closed-end funds, there is no public second hand market or trading platform where you can buy and sell the shares. Most of the investors hold their close ended fund shares until maturity date. Sometimes, fund advisors or general partners will buy shares from investors if they reach an agreement (or with a pre-set agreement).

The Life Term For Golden Visa Funds

The Golden Portugal offers a variety of open end and closed-end fund options for Golden Visa investments, typically with terms ranging from 7 to 10 years (for closed-end fund). The form of returns depends on the fund’s structure and investment type. Some funds distribute dividends during the holding period, while mainstream funds aim to realize the maximum return upon maturity, at which point the assets in the fund will be sold and capital gains, along with the capital invested, will be distributed back to the shareholder.

It’s important to note that the share prices of closed-end funds are not determined by trading markets. Instead, the fund’s value is assessed periodically. Approximately every six months, an evaluation of the fund’s assets and income is conducted to determine the net asset value (NAV), similar to how a company’s performance or property is appraised.

Open End Funds Versus Closed End Funds

Get in Touch with a Visa Specialist

Buying and Selling:

- Open-End Funds: These funds offer higher liquidity, allowing you to buy and sell at any time.

- Closed-End Funds: After issuance, these funds are not publicly traded. Normally, investors hold onto the fund until its maturity date. Sometimes, fund advisors or partners may buy the fund shares from investors (upon mutual agreement or pre-arrangement). The Golden Portugal offers several funds where the general partner or fund advisor enters into an agreement with investors, allowing them to exercise a put option to sell the fund back to the general partner or fund advisor at a predetermined time and price. This offers peace of mind and more certainty for the most conservative investors. Contact us to learn more.

Number Of Shares

- Open-End Funds: Unlimited number of shares, which fluctuates with buying and selling activities by the investors.

- Closed-End Funds: The number of shares is fixed and doesn’t change after the initial subscription period.

Share Pricing

- Open-End Funds: The share price is based on the NAV, which is the value of all the investments divided by the number of shares.

- Closed-End Funds: The share price is based on the NAV determined by periodic reassessments of the fund’s assets and income, not by supply and demand on any trading market.

Fund Performance Record

- Open-Ended Fund: Open-ended funds typically have an established track record. This historical performance data is often highlighted in their brochures to give potential investors an idea of past returns. Despite having a track record, open-ended funds always include a disclaimer that past performance does not guarantee future results. This is due to the unpredictable nature of the financial markets.

- Closed-Ended Fund: Many closed-ended funds, especially newly established ones, do not have a track record. However, some funds may be in their second or subsequent series and could provide performance data from previous iterations.

Anticipated Return & Predictability

- Open-End Funds: These funds primarily invest in the stock and bond markets, with their value influenced by fluctuating financial markets and macroeconomic factors. Due to their speculative nature, predicting trends and future returns can be challenging.

- Closed-End Funds: Unlike the speculative nature of stock prices, closed-ended funds can most likely provide an expected return based on the performance of tangible assets and businesses, such as renewable energy, agriculture, and tourism. This reflects a feasible forecast and makes managing returns easier. Fund managers can study the profitability of these assets to forecast, leading to a more reliable future returns.

Nature of Returns

- Open-Ended Fund: Most likely in the form of interests or dividend from the invested stocks or bonds

- Closed-Ended Fund: Depending on the fund structure or the investment types of the fund, the fund may have dividends as well. But most of the funds will realize their biggest return upon maturity, when the fund divest and sell off investments.

Why Invest In Closed End Funds?

When weighting the features and key differences between closed-end and open-end funds, open-end funds offer certain advantages in terms of liquidity, making them relatively easier to buy and sell. However, when the primary investment goal is immigration rather than merely increasing trading income or capital appreciation, the entire investment strategy needs to be reconsidered. Given the unique features of closed-end funds, they are, to some extent, a more suitable choice for Golden Visa investments.

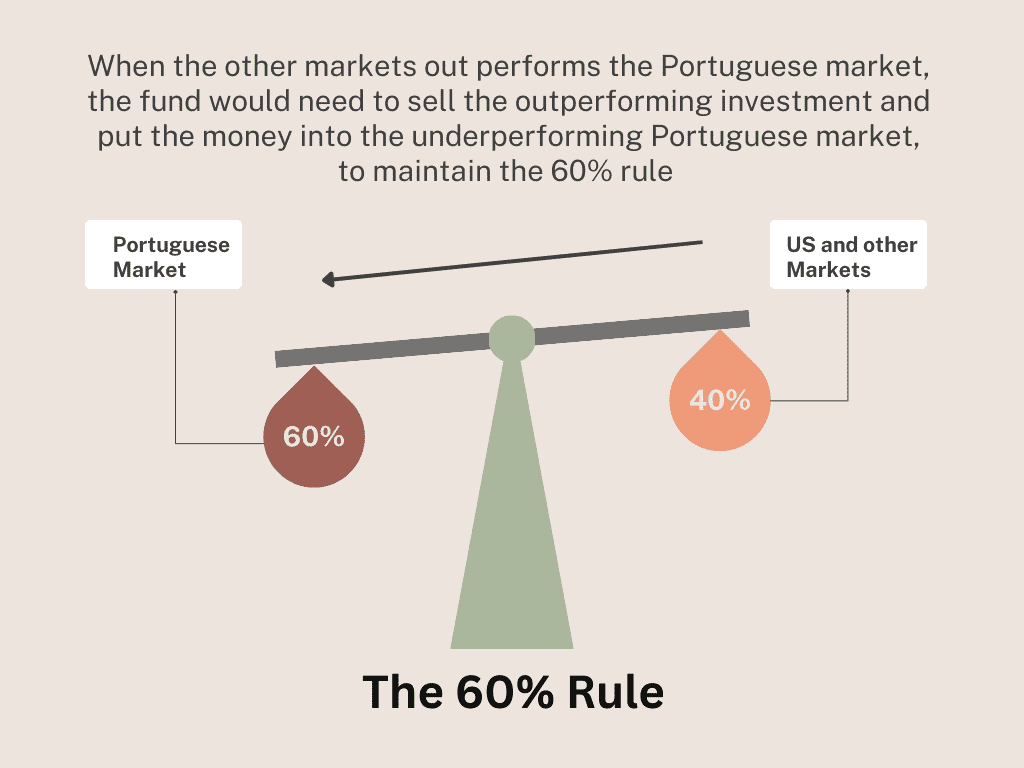

Reason One: The 60% Golden Visa Investment Rules

To qualify for a Portuguese Golden Visa, certain prerequisites for investment funds must be met. One key rule requires that at least 60% of the investment be in the Portuguese economy.

Because of this 60% rule, open-end funds may face disadvantages.

Imagine an open-end fund invests 65% in the Portuguese market and 35% in other markets. Whenever other markets perform better than the Portuguese market (e.g., the U.S. stock market grows by 10% while the Portuguese market declines by 5%), the fund would need to sell its U.S. stock investments and reallocate the capital to the Portuguese market to maintain the 60% rule. This forces the fund to sell outperforming investments and invest in underperforming ones.

Closed-end funds are relatively less affected by this requirement since their fund evaluation doesn’t change drastically from one day to the next.

Reason Two: Higher Investment Stability

As previously mentioned, open-end funds need to follow market trends to maintain optimal returns. They tend to focus on short-term investments, involving frequent buying and selling. This can expose investors to sudden changes, forcing the fund to sell assets at unfavorable times. In contrast, closed-end fund investors typically hold the fund until maturity, facing less pressure and risk related to rapid asset sales. This can lead to more stable and potentially higher long-term returns, making closed-end funds more suitable for Golden Visa applicants with investment periods of 6-7 years or more. Designed for medium to long-term investment, these funds encourage investors to hold and focus on long-term growth rather than short-term gains.

Reason Three: More Diversified Investment Options

Open-end funds primarily invest in Portuguese stocks and bonds, meaning there is less diversification. The Portuguese stock market is highly volatile, with the Portuguese Stock Index (PSI 20) comprising less than 20 companies, and only a few being truly large corporations. Conversely, closed-end funds invest in various sectors such as renewable energy, agriculture, and tourism. This diversified investment portfolio can reduce systemic risk, as funds are spread across different industries rather than being concentrated in just one.

Reason Four: Higher Return Potential

The returns of open-end funds are limited by the performance of the Portuguese stock and bond markets. The Portuguese Stock Index (PSI 20) has shrunk, with only a few traditional energy companies like Galp and EDP, and very few emerging industries, indicating limited growth potential. On the other hand, closed-end funds, which invest in specific sectors such as renewable energy, agriculture, and tourism, offer higher growth potential. Tourism is a major driver of the Portuguese economy, and renewable energy is a growing trend in both Portugal and Europe.

Reason Five: Predictable Returns & Valuation

Open-end fund prices fluctuate based on stock and bond market trends, making them more volatile and harder to predict. In contrast, closed-end funds are valued based on the assets and periodic income of the fund, providing a clearer understanding of the actual investment value. These periodic and predictable revaluations gives investors a better peace of mind of where their investment stands.

Reason Six: Reduced Market Volatility

Open-end funds are publicly traded, making them more susceptible to market volatility and investor panic, which can lead to frequent value changes. Conversely, closed-end funds are not traded on public markets, meaning they are less affected by daily market fluctuations and investor sentiment, resulting in more stable investment performance.

Key Takeaways: Pros & Cons

| Pros | Cons |

| Unlimited number of sharesEasy to buy and sell | Lower potential returnsAffected by 60% Golden Visa RulesHigher volatility |

Closed Ended Fund : Long Term Focused

| Pros | Cons |

| Higher potential returnsLower volatilityMore predictable returnsMore Diversified Investment OptionsMore suitable for mid to long term investments | Can be less liquid |

Conclusion

As we can see from the above, closed-end funds excel in stability, risk diversification, return potential, and predictable valuations. They are also better aligned with the investment goals for Golden Visas investors compared to open-end funds. Typically, Golden Visa investors hold their investments for an average of 6 to 8 years. For such long-term immigration investments, choosing closed-end funds offers greater security and attractiveness.

If you are someone who prefers higher risk, you might still opt for open-end funds due to their ease of trading. However, it’s important to remember that the primary goal of a Golden Visa is not trading. The Portuguese stock index is vastly different from indices like the S&P 500, with distinct growth and profit prospects for the companies. For any investment decisions, consulting with the respective fund manager is advisable and we are here to arrange the call or meeting for you.

Taxation

Additionally, if you’re interested in open-end funds, it’s recommended to inquire about the fund’s tax situation with the fund manager. For non-tax residents and tax residents, closed-end funds typically have different tax implications, with 0% for non-tax residents and 10% for tax residents. Regarding income tax, some open-end funds do not enjoy favorable tax treatment!